From tap to transaction: power real-time mobile banking with Redis

From branches to smartphones

Today, a bank’s most important branch fits in the palm of your hand. Mobile apps have revolutionized banking, turning time-consuming tasks—like depositing checks, transferring funds, or checking balances—into instant, effortless transactions. With mobile apps, banking is faster, easier, and more accessible than ever before. In fact, according to a 2023 Deloitte study, the average mobile banking transaction takes under 90 seconds to complete, while the same transaction in a physical branch takes over eight minutes.

With these types of outcomes, it’s no surprise that mobile banking now accounts for over 60% of banking transactions across the globe. Behind every new tap or swipe is a complex set of systems—and many of the world’s top banks rely on Redis to keep it all running in real time.

Rising mobile demand leads to new tech challenges

While mobile banking has significantly enhanced customer experiences, it has also increased pressure on banks’ technology teams. Many still rely on legacy tech stacks designed for core business apps that require ongoing support, even as demand grows for modern, high-performance mobile apps.

As a result, banks now face a range of complex challenges driven by rapidly evolving customer expectations and the accelerating pace of digital banking.

- Latency: Customers expect instant gratification. They won’t tolerate slow-loading screens, laggy user sessions, or delays when accessing account information, recent transactions, or completing simple tasks.

- Scalability: The rise in mobile banking adoption has created significant strain on backend systems and requires infrastructure that can scale quickly to handle spikes in traffic and demand—especially during peak times.

- Reliability: Customers expect banking apps to function flawlessly at all times. Downtime, outages, or even minor performance issues can lead to frustration, loss of trust, and customer churn.

- Data silos: Modern users expect a unified, seamless experience across all banking channels—whether they’re visiting a branch, using a website, or interacting through a mobile app. They also want continuity across products, such as checking, savings, credit, and home loans. Achieving this is often hindered by fragmented infrastructure and siloed data systems. These mobile-specific challenges are just one piece of a much broader transformation happening across the financial services industry. Explore how top banks are using Redis to modernize everything from fraud detection to customer personalization.

Tackling these issues requires more than speed—it demands smarter architecture, modern tools, and real-time performance. And that’s where Redis comes in.

The world’s leading banks overcome these challenges with Redis

Redis makes it easier to tackle the toughest challenges in modern banking technology. With real-time performance powered by in-memory data storage, Redis provides instant access to data. Seamless scaling keeps systems running smoothly, even during common traffic spikes or times of unexpected demand. Redis is also incredibly developer-friendly and fits easily into modern tech stacks, with flexible data types, multiple deployment options and a robust developer ecosystem.

These advantages are why 6 of the top 10 Fortune 100 banks rely on Redis to power their most critical apps. Here are a few of the ways Redis is commonly used when building mobile banking apps.

Fast, scalable session storage

Session storage involves temporarily holding state and data related to a user’s or system’s activity during a user session (from when a user logs into an app to when they time out or log out). During the session, apps need to keep track of a user's interactions and state while they’re actively using the app.

Examples of the types of session data that banks commonly store in Redis are:

- Device information

- Location data

- Recent actions

- Form input data

- In-progress transactions,

- Personalized user preferences.

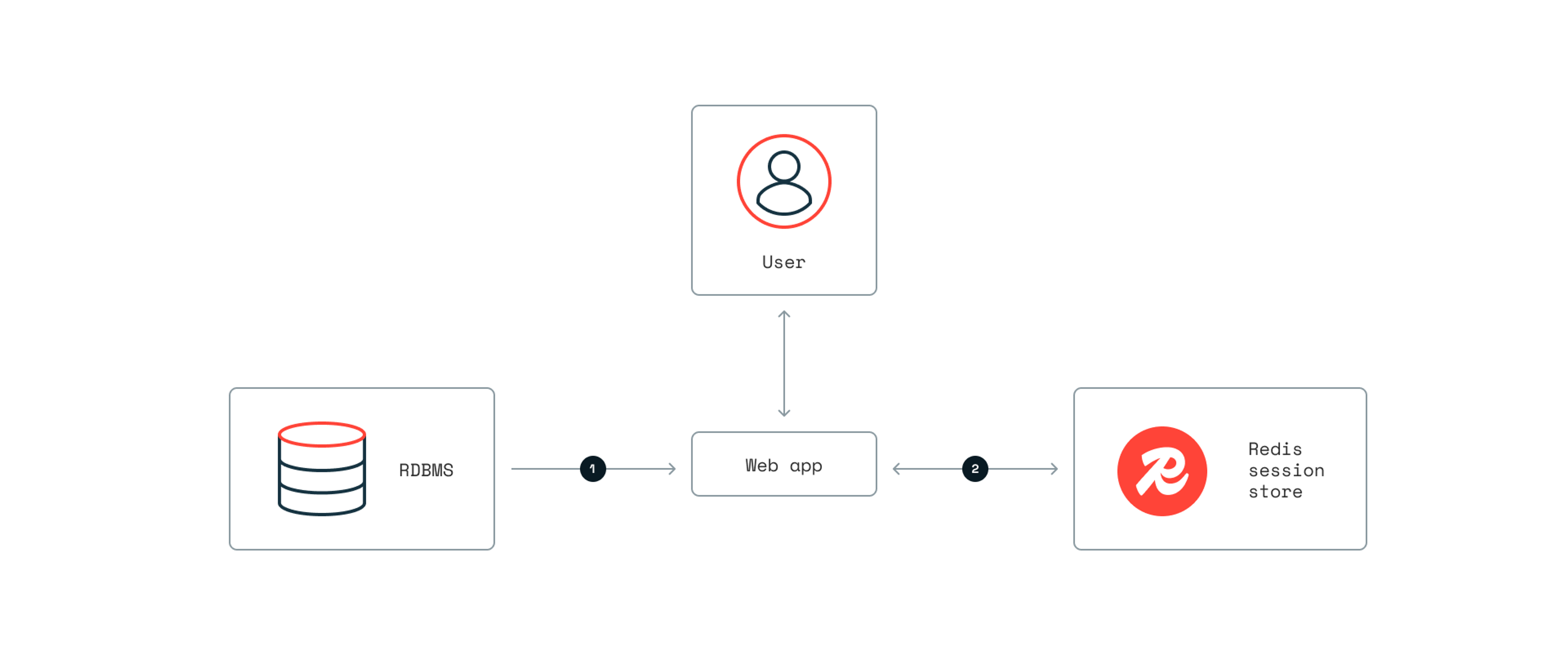

Here’s how it works

- When a user logs into their banking app, a user session is created and data is loaded from an RDMB into the session store in Redis.

- When a user interacts with the app, the app fetches and updates session data, such as recent actions, location data, and more from the session store in Redis.

Why choose Redis for session storage

When using mobile apps, banking customers expect instant responsiveness. Fast session storage ensures smooth execution of critical actions like payments, fund transfers, or fraud alerts, where delays could result in financial loss or failed operations. Banks turn to Redis for:

- Real-time speed: Redis delivers fast, in-memory data access, making it ideal for managing user sessions with the real-time speed demanded by years.

- Rich data structure support: Redis supports session-friendly formats like Hashes and JSON, enabling efficient organization and retrieval of complex session information.

- Developer flexibility: Its versatile data structures allow developers to structure session data in ways that optimize both performance and maintainability.

- Scalability: Redis scales horizontally, allowing it to handle growing user bases and traffic spikes without performance degradation.

Responsive & secure authentication token storage

Authentication token storage is a mechanism for storing an authentication (or auth) token that authorizes a user to access an app. An auth token is like a wristband given at an event that eliminates the need to ID repeatedly.

For customer experience, auth tokens enable seamless and secure access to financial services, minimizing login friction and improving user convenience across apps and sessions.

Auth tokens are critical enablers of open banking by enforcing user consent and providing controlled, time-bound third-party access to banking APIs.

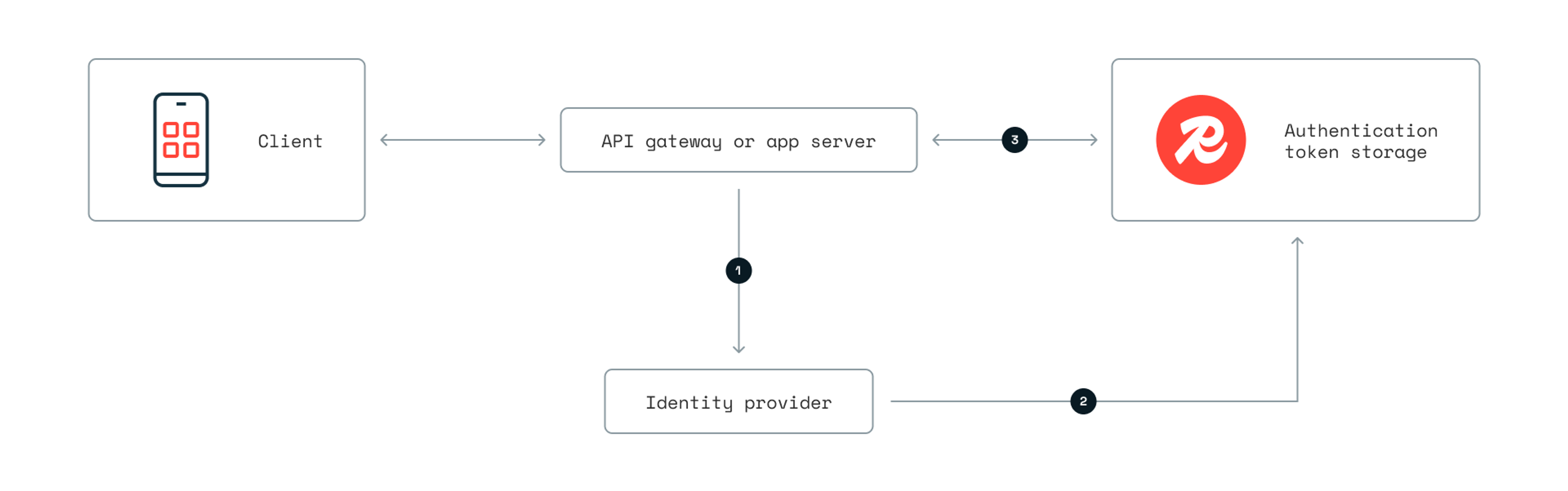

Here’s how it works

- A user or third-party API validates using its credentials.

- An authentication service or identity provider validates the user or API and generates an authentication token.

- The authentication token is stored in Redis for the duration of a user’s session. The app and all its components can consult the token to confirm validation.

Why choose Redis for authentication token storage

- Instant responsiveness: Redis’s in-memory architecture enables near-instant retrieval of tokens, ensuring fast authorization for high-throughput API requests.

- Resilient: Authentication tokens must be consistently available to avoid failed API requests or service interruptions; Redis offers robust 99.999% availability with replication, clustering, and automatic failover, ensuring reliable token access even during node failures or traffic surges.

- Simplified token lifecycle management: Redis natively supports time-to-live (TTL) settings, making it easy to automatically expire tokens after a set duration, improving security and simplifying token lifecycle management.

User profile storage for more secure, personalized mobile experiences

User profile storage in mobile banking apps refers to securely saving user-specific information such as contact information, preferences, and account settings. This allows banks to deliver a personalized and seamless UX across devices.

Combined with account activity, user profiles (containing income, age, credit history, etc.) can also be used to determine if a specific user is a good match for a specific line of financial offer, like a CD account or a new line of credit.

User profiles often include behavioral and device-related data—such as login frequency, trusted devices, and usage patterns—which play a critical role in fraud detection. For instance, if a user who typically logs in from Los Angeles on an iPhone suddenly attempts access from a Windows laptop in Brazil, the system can flag this as suspicious behavior. By continuously analyzing profile data, mobile banking apps can proactively identify anomalies and help prevent unauthorized access before it becomes a threat.

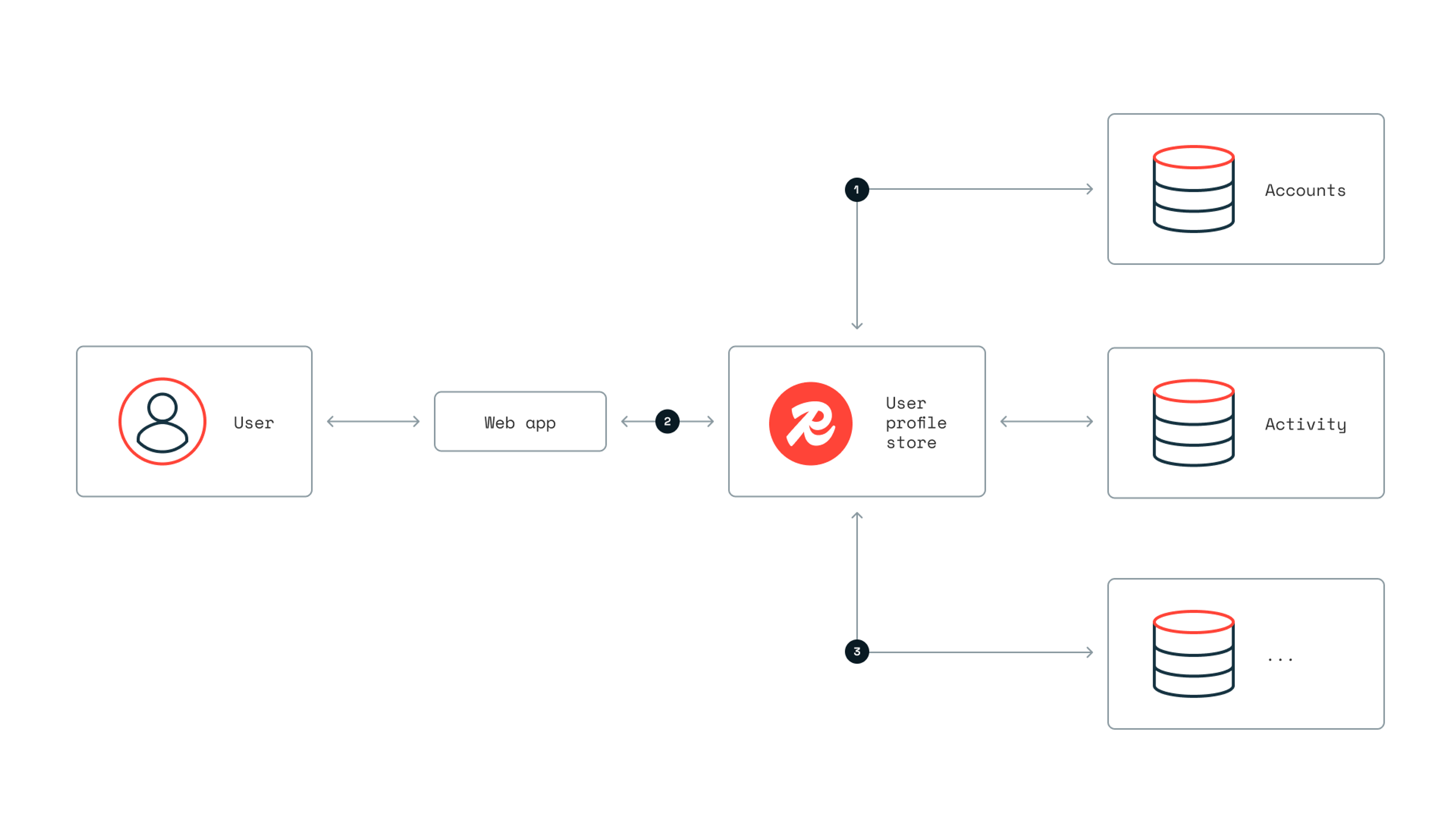

Here’s how it works

- A user profile containing user data is aggregated from primary databases to make the data fast and easily accessible.

- When a user logs in to an app, the app fetches the profile from the user profile store. As the user interacts with the app, any updates are written to their user profile.

- When the user completes their session, any updates to the user profile can be written from Redis back to the primary databases.

Why choose Redis for user profile storage

- Real-time speed: When users log in to apps, profiles (and preferences) can be loaded instantly, making the login process much faster. Additionally, the ability to quickly access user profiles opens new opportunities for real-time recommendations and fraud detection.

- Rich data structure support: Redis supports Hashes and JSON, which are common data formats used for user profiles.

Cache prefetching to power fast, unified banking experiences

Cache prefetching involves proactively loading and storing data in a cache before the user even requests it. This ensures that fresh and accurate data is available immediately.

Banks often use this method to create dashboards that show all their accounts together. Customers can see everything from checking and savings accounts to loans, credit cards, and investment accounts.

Because these dashboards often have data from many product lines, it often needs to be called from many separate databases. This means a bad UX when all of the data needs to load.

With cache-prefetching, banks can preload high-value customer data (like balances and recent transactions) from siloed backend databases into Redis and read data to power unified cross-account dashboards. And because of Redis Data Integration (RDI), banks can ensure that data is always fresh and accurate.

Cache-prefetching with RDI is also often used to keep data consistent across channels. A database that supports core banking systems can prefetch data int Redis, which can then be used to deliver instant data to a mobile banking app—without data consistency issues between the two systems.

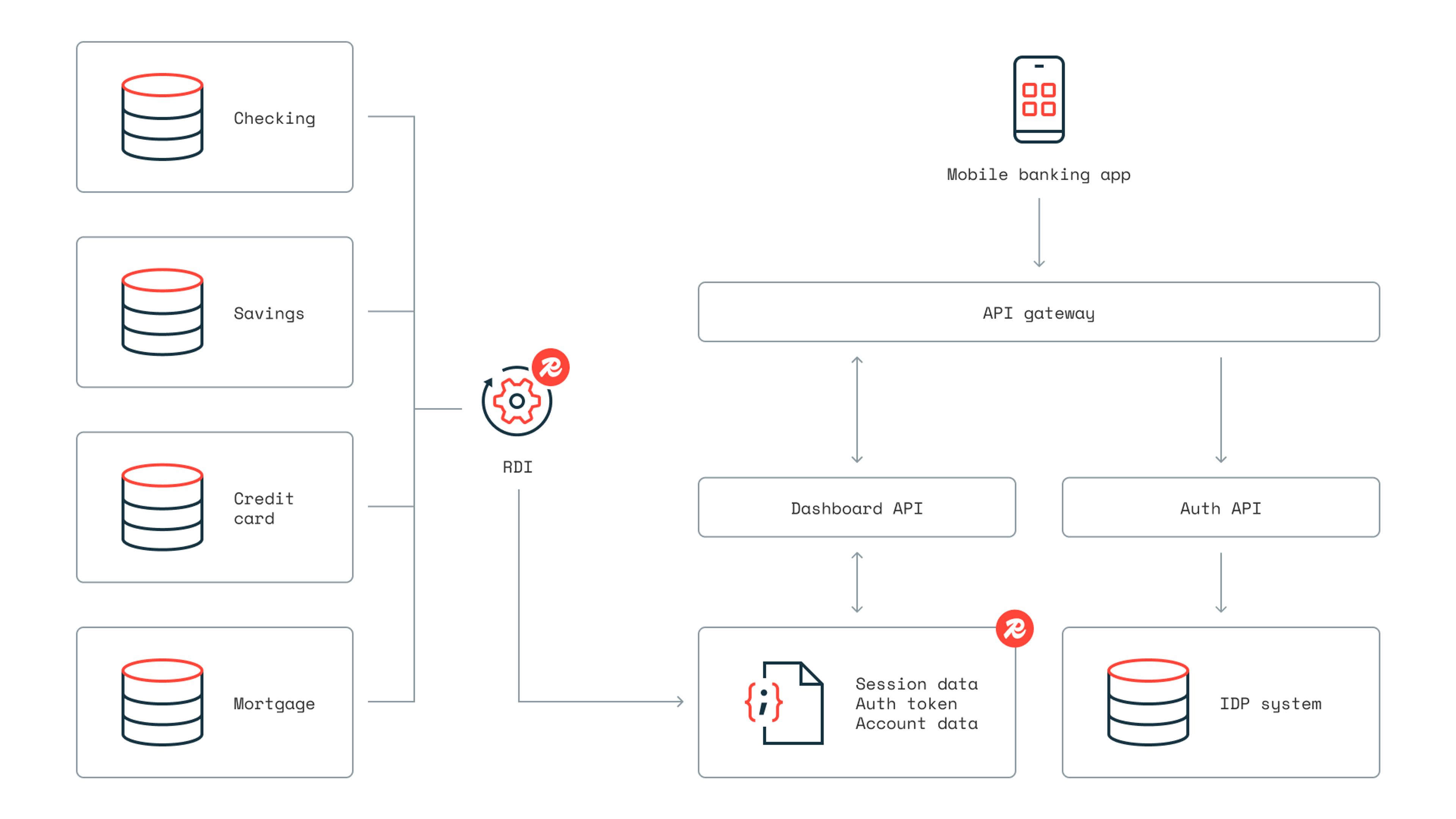

Here’s how it works with RDI

- Banks store data in disparate databases that support individual banking products like checking accounts, savings accounts, credit cards, mortgages, etc.

- Data is prefetched from banking databases into Redis using RDI—and as data changes in backend systems, it is proactively updated in Redis

- Mobile banking apps read this data directly from Redis in real-time

Why choose Redis for cache prefetching

- Real time speed: Real-time speed enhances mobile app performance, delivering key account information to banking customers faster and more efficiently.

- Seamless data integration: RDI makes it easy for banks to get data and keep it up-to-date. It captures changes, transforms them into Redis data types, and ingests data into Redis smoothly. This means data is loaded into dashboards before users even ask for it. This means data is loaded into dashboards before users even ask for it.

- Scalability: Unparalleled scalability helps to eliminate app bottlenecks, like loading high-value account and transaction data, and perform flawlessly during times of peak demand

- Resilience: 99.999% uptime, durability, and fast failover ensure that customers always have fast access to the critical data they desire

See it in action with Axis Bank

Axis Bank’s mobile app was designed to show users up-to-date account details, including product changes and authorized users. However, updates made offline at branches weren’t syncing with their mobile app due to limitations of the bank’s traditional database infrastructure. This disconnect was resulting in poor customer experience and dissatisfied customers.

By leveraging Redis Data Integration (RDI) to prefetch data, Axis Bank achieved real-time synchronization across its nine core banking tables, ensuring seamless, automated updates across channels. This not only aligned the mobile experience with in-branch interactions, but also improved app performance by 76% and reduced infrastructure costs by $82,000 through more efficient data storage and management.

The bottom line

To meet the rising demands of mobile banking users, leading banks are building apps that are fast, reliable, and scalable—powered by Redis.

From session management and authentication to real-time user profiles and cache prefetching, Redis delivers the real-time performance and resilience modern mobile banking apps require.

With flexible data structures, seamless integration, and high-availability, Redis enables banks to create secure, responsive mobile experiences that build trust and drive customer satisfaction. And mobile banking is just the beginning. Discover how Redis is helping financial institutions drive innovation across their entire business.

Ready to create a better mobile experience? Here’s how to get started: book a meeting or start building for free.